Al joins Amy Wagner and Steve Sprovach on Simply Money Radio for a rare discussion about the lessons you can learn from wearing underwear, but whose underwear in particular?

Three Things Money Can't Buy

Money is an essential tool that allows people to provide for themselves and their families by having access to basic necessities like shelter, food, clothing, transportation, and insurance. Although it is vitally important throughout life’s journey, money cannot buy everything. When thinking about some of your most enjoyable life experiences, the first thing that comes to mind is probably not money.

In addition to the most often heard things money cannot buy — time, health, and happiness — there are three additional items which belong on the list:

Passion: The probability is quite high that there is at least one thing you enjoy doing despite the fact that money might not be your driving motivation. Passion can show up in many ways. Some people have a passion for cooking, landscaping, teaching, volunteering, or traveling. Your passion could be something you are genuinely interested in doing. It might cost money to do, but the enjoyment you get from that particular activity is far more valuable than money. Money can’t buy your passion; however, it can help unlock the door by providing more opportunities to try new things.

Knowledge: Not everyone has a quest to obtain knowledge through real-life experience. There may be people in your life who routinely make the same mistakes (e.g., financial, relationships) despite the fact that you believe they know better. Just because people know better does not mean they will automatically do better. This is the main difference between education and knowledge. Education can be a formal process like attending school or college. Knowledge is based on accumulating information gained through experience. A good education can lead to a high paying job, but that doesn’t mean a person who earns a high income has mastered the art of personal finance. This skill can only be gained through experience or the willingness to emulate the behaviors of someone who has experienced financial success.

Genuine relationships: When people only want to be associated with you because of your status, possessions, or influence, RUN! These types of individuals are looking to gain something from you. Beware of Takers! They are easy to identify because their normal pattern of behavior is to be in a position of receiving because they rarely, if ever, give. Unfortunately, this often shows up more in family relationships than friendships. Authentic relationships can’t be bought and, more often than not, are formed through time and effort. Real friends usually act in a way that shows they do not mind spending time with you, sharing your interests, or showing up in your time of need. The same can be said of familial relationships as well.

Money cannot buy everything and it does not have the power to make you happy and fulfilled; however, it is important. If you had $100,000 more today than you did yesterday, your relationship with each of the previously mentioned topics would not change much in the short-term. In addition to some of your needs and wants being met, you might find some temporary fulfillment and satisfaction. To achieve long-term happiness, something not as tangible as money can give you that. Success in life rarely has anything to do with having a five- or six-figure bank account balance. Money is only a tool.

The Power of Paying Cash

Level Up Your Financial Life Today

One of the lessons most often heard by young people new in their careers is, “Start saving now for retirement.” Unfortunately, it can easily fall on deaf ears because it is difficult for youth to imagine themselves growing old and living off money they’ve saved for decades. Not to mention how they have to deal with the FOMO (fear of missing out) or YOLO (you only live once) mindset.

If you can’t imagine the older version of yourself, try the aging booth app. After you snap a photo of your face and see yourself age 10 or 20 years, answer two questions: 1) What kind of life do you want your future self to have? 2) What behaviors with money do you need to improve or modify to give yourself the best chance at making your future life a reality? When Al and Lesia answered these questions many years ago, learning about investing was one of their action steps.

Once you understand the basics of what to do with your money, the biggest challenge is taking action and having the discipline to duplicate the appropriate behaviors over and over for years. The second biggest challenge is resisting lifestyle creep (i.e., the more you make the more you spend). This is where most people experience self-inflicted financial pain. It can be hard to put off spending a dollar today with the calculated hope of being able to turn that $1 into $4 in the future. Usually, once this task is mastered, the process becomes easier.

Accumulating new stuff throughout your life is almost second nature, but the excitement attached to the new stuff quickly fades away. You might thank yourself, later in life, if you learn early that time and money can be the best of friends. Or better yet, if you have an affinity for acquiring new things, why not figure out more ways to acquire new money. There are many ways to do this: business ownership, entrepreneurship, investor, real estate. The key is to determine which way is best suited to your behaviors.

Al thought it would be fun to look at how he and Lesia’s finances have changed throughout their 20 years of marriage. To answer this question, he opened an Excel file which captures two decades of their financial lives at a glance. There were two times when their net worth decreased from the previous year (10% of their marriage) and 18 times where it increased (90%). Those are pretty good odds. The largest decline was $134,972 and the largest increase was $698,734. Despite the ups and downs, their monthly behaviors have remained the same.

Life happens no matter how much you try to plan and prepare. Nobody is immune from situations that might make them tap into their emergency fund. Here are a few examples of unexpected expenses for the Riddick household from Al’s 20-year snapshot: basement flood, replacements of the AC unit, furnace, hot water heater, oven, refrigerator, dishwasher, and roof. On top of all that, Al was laid off in 2010. Whenever a new obstacle comes your way, the only rational thing you can do is meet it head on and figure out a way to get through it or over it as quickly as possible.

Spend some time, after reading this post, to determine what you want out of life and then begin devising a plan to get it.

Getting Fired Can Save You Money

People who enjoy yard work have always been a mystery to Al Riddick. While growing up in Littleton, NC, he mowed lawns so he could afford to buy brand-name gym shoes and clothes. Today, he hates the scent of freshly cut grass because it reminds him of all the hours he spent in the sun mowing lawns in his youth.

His wife does not believe he once entertained the idea of having a yard full of dirt and rocks instead of grass like normal homeowners. Luckily, when Al was searching for a home pre-Lesia, his realtor convinced him that idea would hurt his resale value. Because they do have grass, Al prefers that it look nice so he gets the lawn treated and mowed. One of his neighbors once mentioned that their grass looks like carpet.

Because Al loves making a deal, he pays for lawn care in a lump sum to receive a discount. Here’s the December 2022 bill:

Instead of paying the discounted bill, Al called the lawn care company and talked with a customer service representative. Eventually, they agreed on a lower price which represented a 10% discount.

Recently, Al received a check in the mail from the lawn care company for $459.46. To resolve his confusion, Al contacted the company and learned that his service had been canceled by accident. After resolving this mystery, Al was instructed to deposit the check. He was then billed $433.44 for the remaining services. After crunching the numbers, Al saved a little over 14% for getting fired as a customer.

Paying for routine services in a lump sum can usually create opportunities to save money. The additional cash flow generated by the cost savings can be put toward building wealth or paying for something else. More cash flow equals more options; the choice is yours.

Similarities Between Playing the Lottery and Budgeting

An All Too Familiar Financial Story

From an early age, the value of a good education is drilled into the minds of most youth. Based on this information, the process of going from elementary, to middle, to high school begins. Along the way, learning different types of arithmetic and math is expected: ABC’s and 123’s, decimals, ratios, percents, Algebra I, Geometry, Algebra II, and Calculus. Throughout this system of indoctrination, the connection between addition, subtraction, multiplication, division, emotions and money is rarely taught.

When people understand the importance of four simple calculations, it is easier to make quality financial decisions. Remember when you were finally in a position to borrow enough money to finance your first car or house? How much of your purchase was based on emotion and how much was based on math? Or better yet, remember the feeling you had after receiving the new car or new house keys? Isn’t it funny how quickly excitement seems to fade after you’ve made a series of monthly payments?

As with all things, eventually boredom sets in and the desire to feel good and look good becomes greater than the desire to live below your means. Since most financial transactions are done in secret, the weight of more debt and higher monthly expenses is usually counterbalanced by one self-talk declaration: I deserve this! Replacing that statement with the question, “Can I afford this?” should yield better financial outcomes. Months and then years go by without realizing the financial impact of short-term decisions. It is easy to do because the act of counting money when making a purchase has been replaced with the action of inserting, clicking, swiping, or scanning.

Fast forward another few years and living life without a budget could make a person believe they don’t work. However, the truth is that budgeting, when done correctly, works 99.9% of the time. Budgets are only as good as the level of commitment toward staying within the boundaries of income and expenses. Unfortunately, as a person’s income increases, some of the things that once were considered luxuries incorrectly become necessities. Confusing the two can make the journey to wealth creation long and difficult.

Rewriting this common financial story can begin tomorrow. Imagine how your life could change if you started using math instead of uncontrolled emotions before making financial decisions. What if you took the time to think about the short- and long-term implications of your spending behavior? How much less stress might you feel if you decided to take 100% control of your financial future from this day forward? There are several possibilities within reach. The only thing you have to do is determine what you want money to do for you now and in the future. Once you have that answer, create a system which produces that result. All systems can be improved, so if you have to tweak yours, that’s what learning looks like.

The Downside of Debt-free Living

Listen to Al’s guest segment on Simply Money Radio 55KRC (8 minutes)

AmEx Comes to Al's Rescue

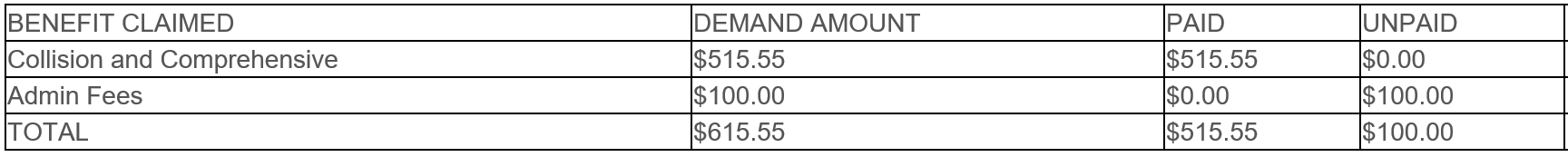

Al returned his rental car to the Philadelphia airport on November 10, 2022 after a trip to NJ. He noticed a crack in the windshield and told the rental car representative. This gentleman used a white crayon to circle the cracks so it could be repaired. The next day, Al received a letter from National with the following words: “Thank you for your recent rental. Our Damage Recovery Unit has received notification of damage or loss to the vehicle you rented.”

The windshield repair was $615.00. Al thought about how he could get this paid and remembered reading about one of his American Express card benefits: Car Rental Loss and Damage Insurance. Al filed a claim with AMEX Assurance Company and was asked to submit the following:

Open Rental Agreement

Photos

Accident/Incident Report

Itemized Repair Estimate

Car Rental Agency’s Demand Letter

After a few weeks of waiting to hear about the outcome of his claim, Al was thrilled to read an email on December 19, 2022 which contained the following.

Although AMEX Assurance Company would not cover the $100.00 Admin Fee, Al was excited to pay only 15% of the total cost out of pocket. In his mind, it was like paying a very low deductible.

Do yourself a favor and learn more about the benefits of your credit card. If you carry a balance from month-to-month, the cost more than likely outweighs the benefit.

Jumpstart Your Financial Fitness in 2023

Al and Lesia had their 20th annual financial year in review meeting during the first weekend in January. Here are a few questions from their meeting that might help you stay on track in 2023:

What is your savings goal for this year?

What behavior modifications are needed to ensure you hit that goal each month?

What future non-monthly expenses should you prepare for now?

What automatic transfers need to be created to reduce monthly financial stress?

Since increasing income and minimizing living expenses are two ways to improve cash flow, which one can you do with the least amount of effort?

How much money do you need to start saving each month to ensure your next vacation is paid for in cash?

By December 31, your life could look much different than it does now. What other questions would you add to this list?

Al's Guest Appearance on the Simply Money Radio Show

The Day Al Lost $462,000

Investing is one of the ways the average American can build wealth. People often say, “I need to make my money work as hard for me as I do for it.” That phrase sounds nice until you feel the term risk tolerance smack you in the face. Your money can work hard for you, but every now and then, it experiences a few sick days. In the current economic environment, it may feel like your most valuable possession is on long-term disability and you don’t know when it will return to work full-time.

Recently, Al became curious to discover how much money he and his wife had lost in the market since the beginning of this year. To his amazement, discovering they now had about half a million dollars less than they did on December 31, 2021 made him pause. The intriguing part about this fluctuation in wealth is that it proves nothing lasts forever.

When everyone was enjoying the bull market run, it would have been easy to think that was a new norm; however, that would have been a huge miscalculation. Now that stock prices have declined, becoming too emotional might make some people deviate from their financial plan. Time in the market usually yields better results than timing the market. The decision to drastically modify your current plan could prove to be catastrophic. Selling when prices have dropped to this extent locks in your losses forever. Alternatively, your emotional sweet spot is found when you can follow a proven plan despite the ups and downs.

Experiencing almost a half million dollar loss in wealth is somewhat intriguing simply because you realize how much time it takes to accumulate that much wealth in the first place. The market does what the market does. Nobody can predict the future and if someone tells you they can, run!

The Pros and Cons of Student Loan Forgiveness

August 24 was a day of celebration for many federal student loan borrowers who earn less than $125,000. Learning about the $10,000 debt cancellation and $20,000 for Pell Grant recipients must have seemed like winning the lottery. According to the Department of Education, approximately 20 million Americans will have their student loans completely eliminated.

This debt forgiveness, like all other federal mandates, will have other impacts as well.

Build wealth more easily - Debt elimination, no matter what kind, can be helpful in the pursuit of building wealth. A $10,000 or $20,000 reduction in debt or liabilities will automatically increase wealth by those same amounts, all things being equal. Remember net worth equals assets (what you own) minus liabilities (what you owe).

Decrease stress – When the load of a financial challenge is lightened, you can’t help but feel a sense of relief while also becoming less anxious about the situation.

Reduce monthly payments - A lower student loan principal balance should equate to lower monthly payments after the payment pause is lifted on January 1, 2023.

Improve your credit score – Student loans are considered installment debt like mortgages or auto loans. FICO scores consist of payment history (35%), debt (30%), length of credit history (15%), new credit (10%), and types of credit (10%). Debt reduction may produce an increase in your score; however, it might decrease your score temporarily. For example, the 20 million Americans whose loan balances will be eliminated altogether might see a slight decrease in their scores if student loans are the only installment loan on their credit profile.

Avoid taxes on loan forgiveness – When the American Rescue Plan Act was passed in 2021, all federal student loan forgiveness became exempt from taxation through the end of 2025. Usually, forgiven debt over $600 is considered taxable income. More than likely, the 13 states that could charge income taxes on this forgiven debt will pass legislation to help borrowers avoid it. The states are Arkansas, Hawaii, Idaho, Kentucky, Massachusetts, Mississippi, New York, Pennsylvania, South Carolina, Virginia, West Virginia, and Wisconsin.

Promote a false sense of financial success – Although a debt may be forgiven, your individual responsibility for proper money management remains the same. The day-to-day financial behaviors you exhibit will have more of a long-term impact than a one-time debt cancellation.

Think about the debt cancellation from a different perspective. From this day forward, what financial behaviors would best serve your future if you won $10,000 or $20,000 tax-free? In whatever way you answer that question, before taking action, remember to count your money then give every dollar you earn instructions so it will behave.

Back-to-school Saving Tips

According to the National Retail Federation, US households will spend an average of $864 this year on back-to-school shopping for a total of $36.9 billion. That little bundle of joy who stole your heart the day you first met has now turned into a human vacuum for your hard-earned dollars. Not to worry though, there are several actions you can take to help lower your cost.

Perform a supply inventory – Check your closets, desk drawers, and bins in the basement to see if you can find hidden back-to-school treasures. Put everything in one location to determine what you have and then create a list of what you need. Compare prices online to find the best deals.

Swap supplies – If you have excess paper and your neighbor/friend has excess pencils, pens, or erasers, trade. Bartering is a good way to get what you need without any money exchanging hands.

Shop at garage sales – If you like to stretch a dollar, garage sales can be a good place to find backpacks, gently used shoes, or clothing. Remember, the term used is basically like saying something is new for the second time. Don’t forget to pay a visit to your local thrift stores to find new clothes. Put them away until school starts so they can feel brand new to your kids.

Google kids consignment stores near me – This simple online search may reveal more locations and savings opportunities than you ever thought existed.

Shop and get cash back with Rakuten – This service is free plus you can earn anywhere from 1% to 3% cash back.

Shop during the sales tax holiday – Remember that $864 that will be spent per household, click here to see a list of sales tax holidays by state.

Buy one new outfit for the first day – After the back-to-school shopping frenzy dies down, prices typically decrease in September. Consider buying one first day of school outfit so your child doesn’t feel left out and then buy more in a month.

Visit churches and community centers – These local organizations usually host FREE giveaways for back-to-school.

If you follow these tips, you will not break the bank. In preparation for next year, consider creating a back-to-school savings account now. Putting a little from each paycheck away will ease the burden next year. You’ve been warned!

WTF Is the Best Personal Financial Question

When you first read this title, you may have thought of a different F word. Gotcha! In this instance, the question is, what to finance? That’s the other WTF you rarely hear about.

When you think about all the things you’ve financed, have you ever stopped to ask yourself if the item you’re about to purchase should be paid for with other people’s money? It is easy, convenient, and habitual behavior to swipe your credit card or tap your smartphone against a point of sale terminal. However, before making the purchase, ask yourself WTF. In a typical month, you might use your credit card to finance gas, grocery, take out, subscriptions, airline tickets, auto repairs, home maintenance products, parking fees, concert tickets, and more. If the bill is not paid, more than likely, you just gave your credit card company permission to take more of your hard-earned wealth from your pockets and put it in theirs. Hello interest!

If this example replays itself in your household like reruns of Girlfriends or Seinfeld, there is a quick fix: Count your money! Pull out your cell phone, click your bank’s app and check your balance. Newsflash! That’s not counting your money; that’s data retrieval. When you see that number beside the word balance, isn’t it amazing that you naturally assume banks or credit unions don’t make mistakes?

If you put your bills on automatic draft, that’s not counting your money either. That’s an example of blind faith. You’re simply accepting the fact that the amount being billed is accurate, no questions asked. We all know retailers never make mistakes with other people’s money, don’t we? If you’re going to give a service provider that much power, the least you could do is inspect what you expect.

You know who’s good at counting money? Students in elementary school! You can be just as good if you simply remain aware of what’s coming in and going out on a week-to-week basis. Comparing those amounts to your projected spend and adjusting accordingly can change your life, if you let it. Counting money might not be fun to you, but it can help you determine WTF or WNTF (What not to finance).

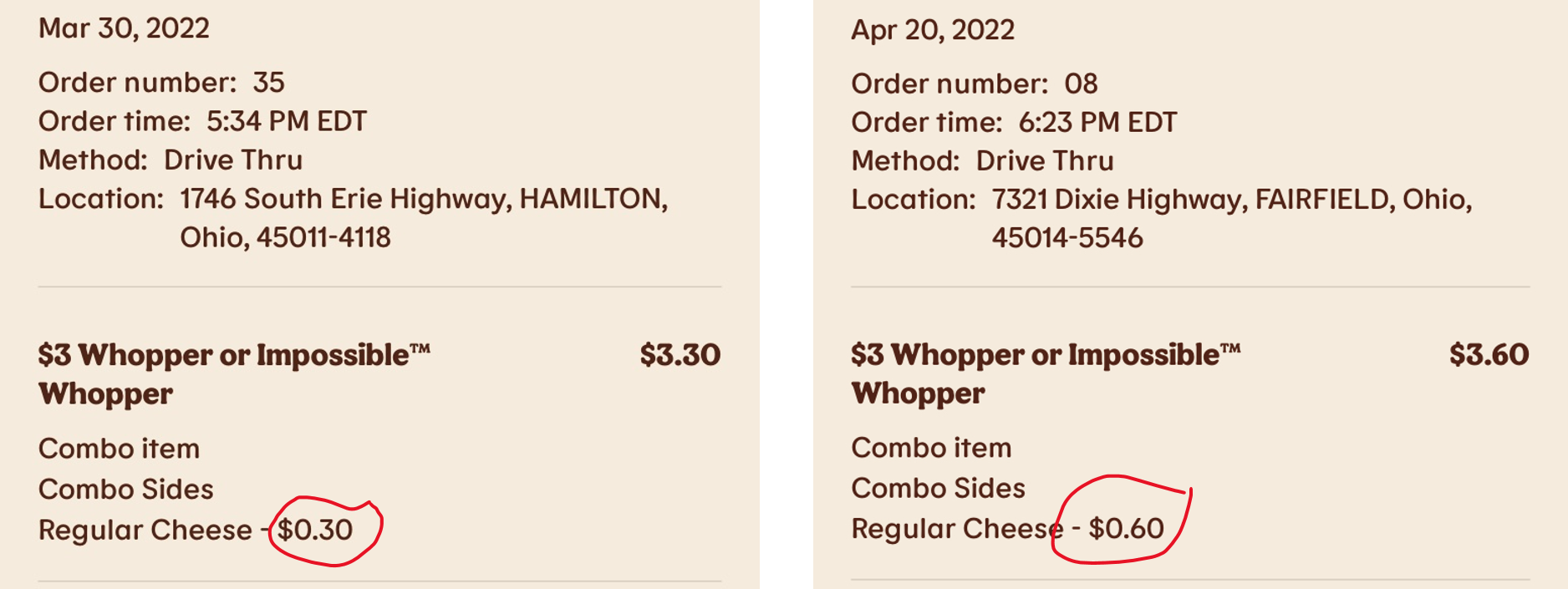

Burger King's Cheese Teaches Personal Finance Lesson

About once a month, Al Riddick treats himself to a Burger King Impossible Whopper. Recently, he noticed the fee for adding cheese had increased by $.30 within three weeks. Thirty cents does not seem like much, but when you consider that there are approximately 7,257 Burger King restaurants in the United States, it’s HUGE. A quick Google search uncovered there are 28 Impossible Whopper’s sold each day per restaurant, on average. That’s roughly 74 million Impossible Whoppers within a year. Instead of cutting the cheese (pun intended), let’s calculate how much cheddar is being generated.

In a year’s time, the thirty cent price increase will add over $22 million in sales. If you don’t think $.30 is a lot of money, think again. This number represents only Impossible Whoppers. Who knows how many people add cheese to the regular Whopper.

When thinking about your personal spending habits, $10 here or $20 there can easily add up to thousands before you know it. Although the increase in cheese prices is alarming, the cool part is that you, as the consumer, have the power to make different choices which can produce positive outcomes.

Let’s say Al chose not to add cheese on his Impossible Whopper and used a 10 cent slice from home. That would save $.50. He has a tough choice to make. Pay a 100% price increase or save over 83% ($.50 difference in cost divided by $.60 Burger King cheese price x 100) by adding cheese at home. You might think this example is over the top; however, when you apply the same logic to higher value purchases (cable, cell phones, clothes, shoes, flights, rental car upgrades), it can save you tens of thousands over your lifetime. Al could simply stop eating Impossible Whoppers, but that would ruin the treat. How many people do you know who are willing to give up things they enjoy? The goal is to enjoy life in moderation living below your means, not in misery.

The Day Al Lost $140,000

Public companies report their quarterly performance, but households do not because that information is private. The second quarter of 2022 begins April 1. It would be difficult to prepare your first quarter financial reports if you are unaware of the outcomes of your financial behaviors. By tracking your monthly transactions like a publicly traded company, describing your performance for the first three months of this year would be easy.

A quick calculation of the Riddick household’s finances revealed a $138,477 loss of wealth from January 1 of this year. To put that number in perspective, imagine yourself driving three miles and throwing $46,159 out the window at each mile marker. You get the picture.

Being aware of the loss is one thing and understanding where it came from is another. The majority of lost wealth came from a decrease in the value of stock investments. Wealth can increase or decrease depending on the market’s movement. This is to be expected and since no shares of any investments were sold, that temporary loss has the opportunity to recover in the future. Ultimately, share price is most important when buying or selling an investment.

Although this loss of wealth occurred over three months, it was not known until calculating the Riddick household first quarter performance. Also, this wealth loss did not cause a kneejerk reaction and initiate a selling spree. The Riddick’s wealth building plan was put in place many years ago and this most recent loss is like a single speed bump on a 10-mile-long road.

If one of your goals at the beginning of 2022 was to save more money, pay off debt, or build wealth, it would be wise to treat your finances as if you are running a million dollar corporation. In actuality, you are. It just so happens that the $1 million in income might take place over a decade or two. There will be many ups and downs during this journey, however, the main goal is to not quit.

Tips for Saving Money on Gas

Gas prices have increased 47% from January of 2021 to January of 2022 according to the U.S. Bureau of Labor Statistics. Although the impact of inflation is being felt at the pump, that doesn’t mean you can’t save money. Here are a few tips to turn pain at the pump back into pleasure.

Fill up on a Monday – Gas prices are lowest on Mondays and Tuesdays. If you’re trying to save money on gas, avoid filling up on Fridays, Saturdays and Sundays when prices are higher.

Slow down – The faster you drive, the more wind resistance you create which decreases the fuel efficiency of your vehicle. Having a lead foot, in this case, comes at a cost.

Use apps to find cheap gas – A few of the apps that help you find cheap gas in your area are GasBuddy and Waze. Don’t wait until your tank is almost on empty because you might be forced to spend more money, especially if the gas station is just off a highway exit or in the heart of a major city.

Check tire pressure – Underinflated tires can decrease your gas mileage and cost you about two cents per gallon. U.S. Department of Energy If you don’t know what your tire pressure should be, refer to your owner’s manual or look on the edge of the driver’s side door.

Join a fuel rewards program – Many grocery store and gas station chains offer fuel rewards programs to try to turn you into a loyal customer. If, for example, you’re a member of a big box store (e.g., Costco), one of the membership privileges is access to their preferred gas price. The next time you’re grocery shopping at Kroger, don’t forget to check your fuel points rewards.

Lighten your load – The more you have weighing down your car, the worse gas mileage you get. Take a look in your trunk and get rid of anything you don’t need, but remember to keep the spare tire.

Use these tips and enjoy saving money on gas right away.

7 Tips to a New Financial You in 2022

Remember the excitement you felt on December 31, 2021 at 11:59 p.m. as the New Year was approaching? Then that excitement increased even more once you began counting down from 10 to 1. Who said that feeling has to stop? You have 11 more months ahead of you in 2022. Keep the celebration going by following these tips.

Focus on pleasure – You weren’t expecting that were you? Most people do not pursue financial goals because they assume it will involve pinching pennies, not having fun, or only eating rice and beans for dinner. Wrong! Focusing on how you would feel after achieving a financial goal will make the journey that much sweeter. Imagine the feeling of accomplishment, not to mention security, you would have if the balance in your savings, emergency fund, or retirement accounts increased after making some simple modifications to your daily behavior. Doesn’t that thought feel good?

Make your money behave – Giving your money instructions is the first step to making sure it follows your rules. Those rules exist inside the boundaries of your monthly spending plan. However, rules only work when you execute. Remember, financial boundaries aren’t barriers; they are safety nets.

Count your money – At a minimum, know how much income is coming into your household each month. Pay attention to pre-tax retirement contributions, payroll deductions and taxes. Whatever amount is deposited into your account on payday is what you have to make your financial dreams come true.

Track your spending – You may have heard this once or maybe a thousand times. If you aren’t tracking your spending, how else can you determine if your budgeted spend is in alignment with your actual spend? It’s your money so count it, track it, and then count it again.

Make big goals small – Once you create a financial goal for the year, break it down into a monthly, weekly, or daily goal. If you’d like to save $600 in 12 months, save $50 a month. You could also save approximately $25 every two weeks. Whatever method makes you feel good about taking action, use it.

Set it and forget it – Subscription services are successful because most people forget what they sign up for. This natural behavior works well when used to put or keep money in your pocket. Many 401k plans have an auto-escalation feature that increases contributions each year. Consider creating an auto-transfer from your checking account to a savings account specifically for your next vacation, weekend getaway, or birthday trip.

Reward yourself: It can be challenging to live a life where you never treat yourself to something that brings joy. As you strive toward accomplishing whatever financial goal you set, small rewards along the way, in moderation, can add happiness by the pound.

These seven tips fit perfectly into seven days a week. If you doubt whether they will work, you’ll never know until you execute; don’t just try. The word try implies that failure is an option. 😊 Keep your celebration going and make 2022 the year of the new financial you.