One of the secrets to getting and staying rich comes down to how your money is earned. Money earned from investing is taxed at a lower rate than money earned from working. The terms unearned income (e.g., from investments) and earned income (e.g., from a job) can have a profound impact on your ability to build wealth.

The following picture shows the cost basis summary for an investment account. Cost basis, in a broad sense, refers to the price you pay for shares of an investment. When you invest, two of the potential rewards are dividends and capital gains. A dividend is a sum of money paid, usually quarterly, by a company to its shareholders out of its profits. Various mutual funds and exchange-traded funds (ETF) also pay dividends. A capital gain refers to an increase in the value of an asset. It is realized when that particular asset is sold. A capital gain can also be unrealized which means that the increased value of an investment is only on paper. For example, if you paid $1,000 for 10 shares of a $100 stock and then the stock price went to $105, your $50 capital gain would only be realized if you sold the stock. If you didn’t sell, the capital gain would be unrealized. As additional information, a capital loss would be realized when selling an asset for less than what you paid for it.

Assume the above information belongs to a fictitious character by the name of Stacy. She’s single and earns $80,000/year. She decides to sell all the shares of this ETF held for more than one year. In the above picture, note the capital gain/loss column heading and the $2,857.27 listed under long-term. Short-term capital gain/loss represents shares owned for less than one year. When Stacy sells this asset, she will need to pay taxes.

Based on your knowledge about taxes, what tax rate do you think will be applied to this capital gain? A) 0% B) 15% C) 20% D) 22%

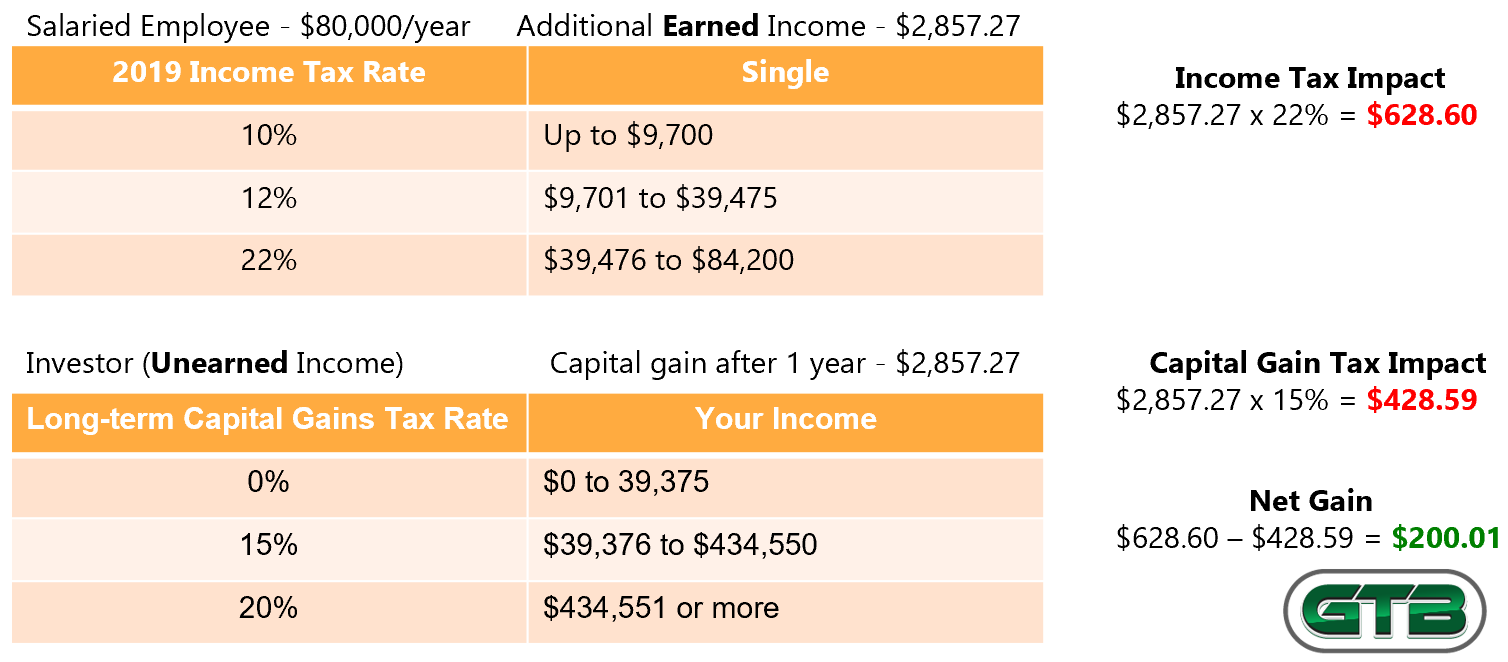

The following image shows how Stacey’s $80,000/year income puts her in the 22% tax bracket. If she had worked more hours on her job to earn $2,857.27, she would owe $628.60 in taxes. However, because she sold shares within her investment account, the capital gains tax rate of 15% (answer B) applies based on her income. She would owe only $428.59 ($2,857.27 x 15%) in taxes. The difference in taxes between Stacy working for money and money working for her is $200.01 ($628.60 - $428.59). All income from work is honorable; however, money earned from a job is more expensive. The tax treatment of unearned income provides a better understanding of why rich people choose not to work for money and let money work for them.