Listen to Al’s guest segment on Simply Money Radio 55KRC (8 minutes)

AmEx Comes to Al's Rescue

Al returned his rental car to the Philadelphia airport on November 10, 2022 after a trip to NJ. He noticed a crack in the windshield and told the rental car representative. This gentleman used a white crayon to circle the cracks so it could be repaired. The next day, Al received a letter from National with the following words: “Thank you for your recent rental. Our Damage Recovery Unit has received notification of damage or loss to the vehicle you rented.”

The windshield repair was $615.00. Al thought about how he could get this paid and remembered reading about one of his American Express card benefits: Car Rental Loss and Damage Insurance. Al filed a claim with AMEX Assurance Company and was asked to submit the following:

Open Rental Agreement

Photos

Accident/Incident Report

Itemized Repair Estimate

Car Rental Agency’s Demand Letter

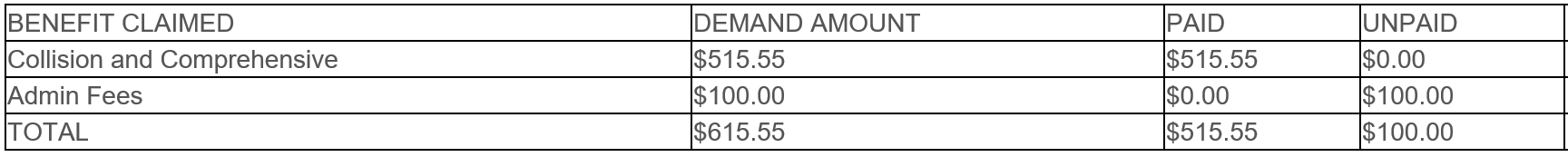

After a few weeks of waiting to hear about the outcome of his claim, Al was thrilled to read an email on December 19, 2022 which contained the following.

Although AMEX Assurance Company would not cover the $100.00 Admin Fee, Al was excited to pay only 15% of the total cost out of pocket. In his mind, it was like paying a very low deductible.

Do yourself a favor and learn more about the benefits of your credit card. If you carry a balance from month-to-month, the cost more than likely outweighs the benefit.

Jumpstart Your Financial Fitness in 2023

Al and Lesia had their 20th annual financial year in review meeting during the first weekend in January. Here are a few questions from their meeting that might help you stay on track in 2023:

What is your savings goal for this year?

What behavior modifications are needed to ensure you hit that goal each month?

What future non-monthly expenses should you prepare for now?

What automatic transfers need to be created to reduce monthly financial stress?

Since increasing income and minimizing living expenses are two ways to improve cash flow, which one can you do with the least amount of effort?

How much money do you need to start saving each month to ensure your next vacation is paid for in cash?

By December 31, your life could look much different than it does now. What other questions would you add to this list?

Al's Guest Appearance on the Simply Money Radio Show

The Day Al Lost $462,000

Investing is one of the ways the average American can build wealth. People often say, “I need to make my money work as hard for me as I do for it.” That phrase sounds nice until you feel the term risk tolerance smack you in the face. Your money can work hard for you, but every now and then, it experiences a few sick days. In the current economic environment, it may feel like your most valuable possession is on long-term disability and you don’t know when it will return to work full-time.

Recently, Al became curious to discover how much money he and his wife had lost in the market since the beginning of this year. To his amazement, discovering they now had about half a million dollars less than they did on December 31, 2021 made him pause. The intriguing part about this fluctuation in wealth is that it proves nothing lasts forever.

When everyone was enjoying the bull market run, it would have been easy to think that was a new norm; however, that would have been a huge miscalculation. Now that stock prices have declined, becoming too emotional might make some people deviate from their financial plan. Time in the market usually yields better results than timing the market. The decision to drastically modify your current plan could prove to be catastrophic. Selling when prices have dropped to this extent locks in your losses forever. Alternatively, your emotional sweet spot is found when you can follow a proven plan despite the ups and downs.

Experiencing almost a half million dollar loss in wealth is somewhat intriguing simply because you realize how much time it takes to accumulate that much wealth in the first place. The market does what the market does. Nobody can predict the future and if someone tells you they can, run!

The Pros and Cons of Student Loan Forgiveness

August 24 was a day of celebration for many federal student loan borrowers who earn less than $125,000. Learning about the $10,000 debt cancellation and $20,000 for Pell Grant recipients must have seemed like winning the lottery. According to the Department of Education, approximately 20 million Americans will have their student loans completely eliminated.

This debt forgiveness, like all other federal mandates, will have other impacts as well.

Build wealth more easily - Debt elimination, no matter what kind, can be helpful in the pursuit of building wealth. A $10,000 or $20,000 reduction in debt or liabilities will automatically increase wealth by those same amounts, all things being equal. Remember net worth equals assets (what you own) minus liabilities (what you owe).

Decrease stress – When the load of a financial challenge is lightened, you can’t help but feel a sense of relief while also becoming less anxious about the situation.

Reduce monthly payments - A lower student loan principal balance should equate to lower monthly payments after the payment pause is lifted on January 1, 2023.

Improve your credit score – Student loans are considered installment debt like mortgages or auto loans. FICO scores consist of payment history (35%), debt (30%), length of credit history (15%), new credit (10%), and types of credit (10%). Debt reduction may produce an increase in your score; however, it might decrease your score temporarily. For example, the 20 million Americans whose loan balances will be eliminated altogether might see a slight decrease in their scores if student loans are the only installment loan on their credit profile.

Avoid taxes on loan forgiveness – When the American Rescue Plan Act was passed in 2021, all federal student loan forgiveness became exempt from taxation through the end of 2025. Usually, forgiven debt over $600 is considered taxable income. More than likely, the 13 states that could charge income taxes on this forgiven debt will pass legislation to help borrowers avoid it. The states are Arkansas, Hawaii, Idaho, Kentucky, Massachusetts, Mississippi, New York, Pennsylvania, South Carolina, Virginia, West Virginia, and Wisconsin.

Promote a false sense of financial success – Although a debt may be forgiven, your individual responsibility for proper money management remains the same. The day-to-day financial behaviors you exhibit will have more of a long-term impact than a one-time debt cancellation.

Think about the debt cancellation from a different perspective. From this day forward, what financial behaviors would best serve your future if you won $10,000 or $20,000 tax-free? In whatever way you answer that question, before taking action, remember to count your money then give every dollar you earn instructions so it will behave.

Back-to-school Saving Tips

According to the National Retail Federation, US households will spend an average of $864 this year on back-to-school shopping for a total of $36.9 billion. That little bundle of joy who stole your heart the day you first met has now turned into a human vacuum for your hard-earned dollars. Not to worry though, there are several actions you can take to help lower your cost.

Perform a supply inventory – Check your closets, desk drawers, and bins in the basement to see if you can find hidden back-to-school treasures. Put everything in one location to determine what you have and then create a list of what you need. Compare prices online to find the best deals.

Swap supplies – If you have excess paper and your neighbor/friend has excess pencils, pens, or erasers, trade. Bartering is a good way to get what you need without any money exchanging hands.

Shop at garage sales – If you like to stretch a dollar, garage sales can be a good place to find backpacks, gently used shoes, or clothing. Remember, the term used is basically like saying something is new for the second time. Don’t forget to pay a visit to your local thrift stores to find new clothes. Put them away until school starts so they can feel brand new to your kids.

Google kids consignment stores near me – This simple online search may reveal more locations and savings opportunities than you ever thought existed.

Shop and get cash back with Rakuten – This service is free plus you can earn anywhere from 1% to 3% cash back.

Shop during the sales tax holiday – Remember that $864 that will be spent per household, click here to see a list of sales tax holidays by state.

Buy one new outfit for the first day – After the back-to-school shopping frenzy dies down, prices typically decrease in September. Consider buying one first day of school outfit so your child doesn’t feel left out and then buy more in a month.

Visit churches and community centers – These local organizations usually host FREE giveaways for back-to-school.

If you follow these tips, you will not break the bank. In preparation for next year, consider creating a back-to-school savings account now. Putting a little from each paycheck away will ease the burden next year. You’ve been warned!

WTF Is the Best Personal Financial Question

When you first read this title, you may have thought of a different F word. Gotcha! In this instance, the question is, what to finance? That’s the other WTF you rarely hear about.

When you think about all the things you’ve financed, have you ever stopped to ask yourself if the item you’re about to purchase should be paid for with other people’s money? It is easy, convenient, and habitual behavior to swipe your credit card or tap your smartphone against a point of sale terminal. However, before making the purchase, ask yourself WTF. In a typical month, you might use your credit card to finance gas, grocery, take out, subscriptions, airline tickets, auto repairs, home maintenance products, parking fees, concert tickets, and more. If the bill is not paid, more than likely, you just gave your credit card company permission to take more of your hard-earned wealth from your pockets and put it in theirs. Hello interest!

If this example replays itself in your household like reruns of Girlfriends or Seinfeld, there is a quick fix: Count your money! Pull out your cell phone, click your bank’s app and check your balance. Newsflash! That’s not counting your money; that’s data retrieval. When you see that number beside the word balance, isn’t it amazing that you naturally assume banks or credit unions don’t make mistakes?

If you put your bills on automatic draft, that’s not counting your money either. That’s an example of blind faith. You’re simply accepting the fact that the amount being billed is accurate, no questions asked. We all know retailers never make mistakes with other people’s money, don’t we? If you’re going to give a service provider that much power, the least you could do is inspect what you expect.

You know who’s good at counting money? Students in elementary school! You can be just as good if you simply remain aware of what’s coming in and going out on a week-to-week basis. Comparing those amounts to your projected spend and adjusting accordingly can change your life, if you let it. Counting money might not be fun to you, but it can help you determine WTF or WNTF (What not to finance).

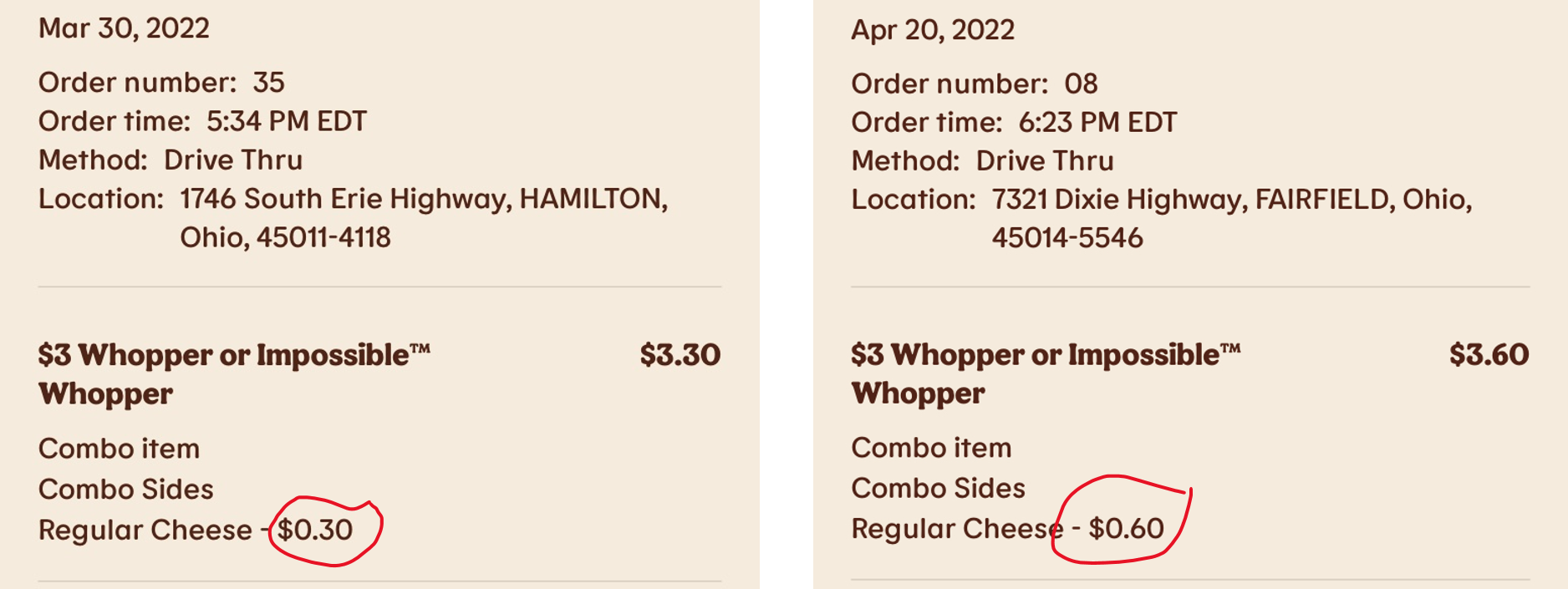

Burger King's Cheese Teaches Personal Finance Lesson

About once a month, Al Riddick treats himself to a Burger King Impossible Whopper. Recently, he noticed the fee for adding cheese had increased by $.30 within three weeks. Thirty cents does not seem like much, but when you consider that there are approximately 7,257 Burger King restaurants in the United States, it’s HUGE. A quick Google search uncovered there are 28 Impossible Whopper’s sold each day per restaurant, on average. That’s roughly 74 million Impossible Whoppers within a year. Instead of cutting the cheese (pun intended), let’s calculate how much cheddar is being generated.

In a year’s time, the thirty cent price increase will add over $22 million in sales. If you don’t think $.30 is a lot of money, think again. This number represents only Impossible Whoppers. Who knows how many people add cheese to the regular Whopper.

When thinking about your personal spending habits, $10 here or $20 there can easily add up to thousands before you know it. Although the increase in cheese prices is alarming, the cool part is that you, as the consumer, have the power to make different choices which can produce positive outcomes.

Let’s say Al chose not to add cheese on his Impossible Whopper and used a 10 cent slice from home. That would save $.50. He has a tough choice to make. Pay a 100% price increase or save over 83% ($.50 difference in cost divided by $.60 Burger King cheese price x 100) by adding cheese at home. You might think this example is over the top; however, when you apply the same logic to higher value purchases (cable, cell phones, clothes, shoes, flights, rental car upgrades), it can save you tens of thousands over your lifetime. Al could simply stop eating Impossible Whoppers, but that would ruin the treat. How many people do you know who are willing to give up things they enjoy? The goal is to enjoy life in moderation living below your means, not in misery.

The Day Al Lost $140,000

Public companies report their quarterly performance, but households do not because that information is private. The second quarter of 2022 begins April 1. It would be difficult to prepare your first quarter financial reports if you are unaware of the outcomes of your financial behaviors. By tracking your monthly transactions like a publicly traded company, describing your performance for the first three months of this year would be easy.

A quick calculation of the Riddick household’s finances revealed a $138,477 loss of wealth from January 1 of this year. To put that number in perspective, imagine yourself driving three miles and throwing $46,159 out the window at each mile marker. You get the picture.

Being aware of the loss is one thing and understanding where it came from is another. The majority of lost wealth came from a decrease in the value of stock investments. Wealth can increase or decrease depending on the market’s movement. This is to be expected and since no shares of any investments were sold, that temporary loss has the opportunity to recover in the future. Ultimately, share price is most important when buying or selling an investment.

Although this loss of wealth occurred over three months, it was not known until calculating the Riddick household first quarter performance. Also, this wealth loss did not cause a kneejerk reaction and initiate a selling spree. The Riddick’s wealth building plan was put in place many years ago and this most recent loss is like a single speed bump on a 10-mile-long road.

If one of your goals at the beginning of 2022 was to save more money, pay off debt, or build wealth, it would be wise to treat your finances as if you are running a million dollar corporation. In actuality, you are. It just so happens that the $1 million in income might take place over a decade or two. There will be many ups and downs during this journey, however, the main goal is to not quit.

Tips for Saving Money on Gas

Gas prices have increased 47% from January of 2021 to January of 2022 according to the U.S. Bureau of Labor Statistics. Although the impact of inflation is being felt at the pump, that doesn’t mean you can’t save money. Here are a few tips to turn pain at the pump back into pleasure.

Fill up on a Monday – Gas prices are lowest on Mondays and Tuesdays. If you’re trying to save money on gas, avoid filling up on Fridays, Saturdays and Sundays when prices are higher.

Slow down – The faster you drive, the more wind resistance you create which decreases the fuel efficiency of your vehicle. Having a lead foot, in this case, comes at a cost.

Use apps to find cheap gas – A few of the apps that help you find cheap gas in your area are GasBuddy and Waze. Don’t wait until your tank is almost on empty because you might be forced to spend more money, especially if the gas station is just off a highway exit or in the heart of a major city.

Check tire pressure – Underinflated tires can decrease your gas mileage and cost you about two cents per gallon. U.S. Department of Energy If you don’t know what your tire pressure should be, refer to your owner’s manual or look on the edge of the driver’s side door.

Join a fuel rewards program – Many grocery store and gas station chains offer fuel rewards programs to try to turn you into a loyal customer. If, for example, you’re a member of a big box store (e.g., Costco), one of the membership privileges is access to their preferred gas price. The next time you’re grocery shopping at Kroger, don’t forget to check your fuel points rewards.

Lighten your load – The more you have weighing down your car, the worse gas mileage you get. Take a look in your trunk and get rid of anything you don’t need, but remember to keep the spare tire.

Use these tips and enjoy saving money on gas right away.

7 Tips to a New Financial You in 2022

Remember the excitement you felt on December 31, 2021 at 11:59 p.m. as the New Year was approaching? Then that excitement increased even more once you began counting down from 10 to 1. Who said that feeling has to stop? You have 11 more months ahead of you in 2022. Keep the celebration going by following these tips.

Focus on pleasure – You weren’t expecting that were you? Most people do not pursue financial goals because they assume it will involve pinching pennies, not having fun, or only eating rice and beans for dinner. Wrong! Focusing on how you would feel after achieving a financial goal will make the journey that much sweeter. Imagine the feeling of accomplishment, not to mention security, you would have if the balance in your savings, emergency fund, or retirement accounts increased after making some simple modifications to your daily behavior. Doesn’t that thought feel good?

Make your money behave – Giving your money instructions is the first step to making sure it follows your rules. Those rules exist inside the boundaries of your monthly spending plan. However, rules only work when you execute. Remember, financial boundaries aren’t barriers; they are safety nets.

Count your money – At a minimum, know how much income is coming into your household each month. Pay attention to pre-tax retirement contributions, payroll deductions and taxes. Whatever amount is deposited into your account on payday is what you have to make your financial dreams come true.

Track your spending – You may have heard this once or maybe a thousand times. If you aren’t tracking your spending, how else can you determine if your budgeted spend is in alignment with your actual spend? It’s your money so count it, track it, and then count it again.

Make big goals small – Once you create a financial goal for the year, break it down into a monthly, weekly, or daily goal. If you’d like to save $600 in 12 months, save $50 a month. You could also save approximately $25 every two weeks. Whatever method makes you feel good about taking action, use it.

Set it and forget it – Subscription services are successful because most people forget what they sign up for. This natural behavior works well when used to put or keep money in your pocket. Many 401k plans have an auto-escalation feature that increases contributions each year. Consider creating an auto-transfer from your checking account to a savings account specifically for your next vacation, weekend getaway, or birthday trip.

Reward yourself: It can be challenging to live a life where you never treat yourself to something that brings joy. As you strive toward accomplishing whatever financial goal you set, small rewards along the way, in moderation, can add happiness by the pound.

These seven tips fit perfectly into seven days a week. If you doubt whether they will work, you’ll never know until you execute; don’t just try. The word try implies that failure is an option. 😊 Keep your celebration going and make 2022 the year of the new financial you.

Maximizing Your Finances in the New Year!

OH Couple Achieves 14 Years of Debt-free Living!

December 21, 2007 was the day Lesia and I submitted our final payment to eliminate $150,000 in debt. One of the unique things I have learned is that it is possible to become comfortable living debt-free just as easily as it is living in debt. However, the former involves a much lower level of stress.

Before we were married, conversations about money were common. After we were married, that practice continued with an added level of intensity. One of the main reasons we decided to eliminate debt was so we could buy our lives back. We had reached a point where we realized that every company to which we owed money owned a little piece of us.

No matter where you are in your financial journey, progress is always within reach. Each successive financial decision you make has one of two consequences; wealth is either moving toward or away from you. The main factors that influence your outcomes are discipline and behavior. For example, discipline will allow you to save $200 every paycheck, but behavior will make you leave it alone.

As I think about the past 14 years, one of the lessons I have learned is that money can only follow the instructions you give it. Just about every financial outcome begins with a decision, either made by you or someone who has influence on your life. If you are not satisfied with your current relationship with money, that can change depending on what you decide to do with the next dollar you earn.

If you would like to learn more about our journey to debt-free living, check out the NerdWallet and Black Enterprise articles featured on our In The News tab: https://www.gametimebudgeting.com/new-page-3. If you prefer a more in-depth version, my book - The Uncommon Millionaire – is a great resource. Here's a link: https://amzn.to/3AYlEtQ

How Happy Are You?

Most people, in general, want to live long and live well. Longevity probably has more to do with what is at the end of your fork or spoon. Mix in a little daily exercise and you may discover your personal fountain of youth. On the other hand, living well is a phrase many people use, but its actual definition often depends on the person. For example, what does living well mean to you? Ask a family member or your best friend the same question and their answer may differ greatly.

The World Happiness Report 2021 ranks Finland as the happiest country in the world. It highlights six significant factors which contribute to happiness: gross domestic product (GDP) per capita, social support, life expectancy, freedom to make life choices, generosity, and corruption levels. Gross domestic product is the total value of goods produced and services provided in a country during one year. Although the United States has the highest GDP in the world at approximately $20 trillion, it ranks 19 on the survey of happiest countries.

On an individual basis, earning above $60,000 to $75,000 per year in income would not achieve a higher level of emotional well-being according to a Purdue University study. To put it another way, millionaires and billionaires may not be happier than you are at this moment. They have more money and wealth, so people assume they have a happier life. Not true!

If you’d like to improve your personal happiness score, implement the following tips:

Spend more time with people you love and who love you in return - In today’s high-tech world, this can be done virtually with ease; however, there’s much to be said for personal human-to-human interaction.

Allow time for yourself – If you like to read, write poetry, watch movies, hike, go to the gym, or volunteer, do more of it.

Be kind to others – The world would be a very different place if people treated others the way they wanted to be treated.

Gain some form of independence – Your first true taste of being independent usually happens when you start living on your own without any assistance from your parents. If you require minimal supervision on your job because you are a master at your craft, that’s another form of independence. Managing your money in a way that allows you to save, invest, spend, and give can also lead to financial independence.

Your desired level of happiness is up to you. Because you can’t go to a store and purchase happiness by the pound, it’s something you have to strive to achieve on a daily basis. Nobody can do it for you.

May the rest of your life be the happiest ever!

Three Financial Fitness Principles You Should Follow

How Much Is Enough?

Most Americans are engaged in an endless pursuit of more on a daily basis. More comes in many different forms: intangible things like love and approval or things you can see and touch like homes, cars, clothes, and money. If none of these wets your appetite, more for you might be the current items in your Amazon shopping cart. The peculiar thing about more is that after whatever you desired is in your possession, the thrill associated with it quickly fades. As a result, the pursuit of more starts again.

Instead of searching for more most of your life, try chasing something that may bring an added bonus—contentment. When you find that state of peaceful happiness, your world will slowly begin to make sense. You will learn that some of the things you thought were important don’t matter as much. You may discover that what you thought you once desired was actually based on the outside influence of family, friends, or repetitive marketing messages designed to stimulate your emotions.

As an example, when people acquire more money, one of the normal patterns of behavior is to spend more. Money was never the real goal. It is only the medium by which something else could be secured to produce a specific feeling. If you take money out of the equation and ask the average person why they do anything, one response that is lurking just beneath the surface of complete honestly is… because I felt like it.

Satisfying those feelings comes at a cost. In the financial world, the dollar you spend today could be costing you four dollars of financial security, peace, and comfort in the future. Regarding money and your pursuit of more, have you ever asked yourself, “What is preventing me from saving/investing a larger amount on a monthly basis to better prepare for the higher cost of the life I want in the future?”

How much is enough? Only you can answer that question.

Tips to Develop a Millionaire Mindset

Ready For Your Final Boarding Call?

Last week, Al received a large manila envelope in the mail from his mom. He opened it, took a quick glance, and placed the contents on the dining room table. Because he got distracted, it remained there. A few minutes later, his wife said, “What’s this?” She picked it up and remarked, “Oh my God! That’s spooky.” Al’s mom had mailed an updated copy of his dad’s obituary. To Al, it was just a document to be filed. To his wife, it represented something much more emotional. Hopefully, his parents will be around for many more years, however, everyone must embrace the fact that nobody lives forever.

Most people find discussing death about as interesting as talking about a colonoscopy. At least with the latter, you should wake up when it is over. However, everyone has that final appointment that cannot be canceled or rescheduled. Just because you may not like discussing your expiration date does not mean you should avoid planning for it. During a recent conversation Al had with one of his financially savvy friends, Derek stated, “I have a will and life insurance because I care about the people I love.” Basically, if you are married, have kids, or a positive net worth, documenting your end-of-life plan is important and taking the necessary steps to prepare financially is crucial.

According to the GoFundMe website, they perform over 125,000 memorial fundraisers each year and raise over $330 million+ per year. There is nothing wrong with people donating to the cause of their choice. However, when you plan in advance, that forethought can often reduce the financial burden on others. This is particularly important for people who have children under the age of 18. If something happened to you unexpectedly, do you have enough life insurance to ensure your dependents are provided for and your celebration-of-life service is covered? If not, direct cremation might be a viable, less costly option. At least this inexpensive one-way ticket will hopefully leave more insurance money to take care of your heirs.

The time spent preparing this information should be one of the top items on your Adulting list. If you know something is going to happen in the future, it is wise to plan for it. When Al and Lesia got married, one of the to-do items on their list was preparing a last will and testament. A few years later, they transitioned to the Lesia and Alfred D. Riddick Family Revocable Living Trust. One of the best advantages of having this document in place is peace of mind which is priceless.

The following items should be considered when planning for your final boarding call:

· Visit Policygenius.com to compare life insurance quotes from various companies

· Prepare a living will and healthcare power of attorney (see OH example)

· Determine your needs - Will vs Trust

· Establish Payable on Death bank accounts

· Secure and protect your digital legacy

Safe travels! 😊

What If $1 Million Is Not Enough!

According to The Global Wealth Report (2021), there are approximately 21 million millionaires in the United States. If you are a member of this group, congratulations! If not, practicing strategic saving and investing behaviors might help you get there by the time you retire.

One of the questions that is easy to forget when planning for retirement is, what does it cost to be you? Having an estimate of your monthly bills in your mind is different than doing the math based on facts. When you are not in the habit of tracking expenses, it is easy to forget spending on gifts, vacations, travel, and home décor while planning for retirement.

Several areas should be taken into consideration before the transition from paid to unpaid work:

· Lifespan – The longer you live, the more money you will need. Depending on your family history and current health status, it is possible that you might make it to 80 years old or beyond. National Center for Health Statistics

· Geography – Where you live has a major influence on how long your retirement nest egg will last. A million dollars in New York City or Los Angeles will not go as far as it will in Huntsville, AL. Cheap Places to Live

· Retirement Income – Social Security might not be able to buy the life you hope to have in retirement. However, whatever amount you receive could slow how quickly funds are depleted from your retirement accounts. Retirement Income Calculator

· Health – Health costs tend to rise as you age. Much of how you live your life in your 40s and 50s, in addition to genetics, will impact your quality of retired life. Consistent exercise and healthy eating actually increase total health care costs due to a longer lifespan. That’s a good thing! Health Care Costs in Retirement

· Lifestyle – If being a free-spirited spender during your working years is a habit, that behavior is even more unsustainable during retirement. Most people do not realize their income drops dramatically when supporting themselves from savings accumulated during their working years.

· Inflation - One million dollars usually has less buying power in the future, in contrast to today, due to a gradual increase in prices which decreases the purchasing value of money.

There is not a one size fits all for retirement planning. Hopefully, focusing on these six categories should prepare you for the life you want as you ride off into the sunset. One million could be enough for some, but not for others. The choice is yours!